new mexico gross receipts tax exemptions

Exempted from the gross receipts tax are the receipts from the isolated or occasional sale of or leasing of property or a service by a person who is neither regularly engaged nor holding himself out as engaged in the business of selling or leasing the same or. Sanctioned by the New Mexico Activities Association 7-9-414.

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

Jet Fuel Gross Receipts Tax Deduction.

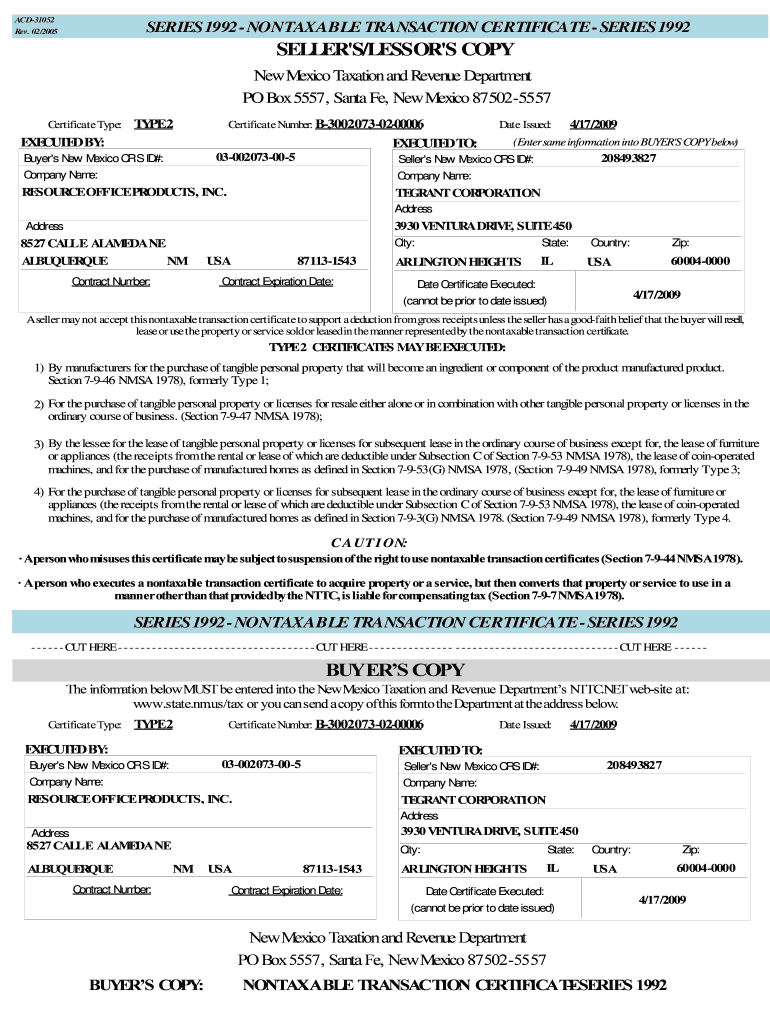

. A new gross receipts tax deduction for certain professional services sold to manufacturers which will help reduce tax pyramiding by about 5 million per year and make New Mexico businesses more competitive. Only income related to your tax-exempt status is nontaxable if you. If you are a reseller using NTTCs may exempt you from paying gross receipts taxes on qualified purchases.

Section 7-9-181 - Exemption. 72013 Page 2 INTRODUCTION This publication includes a description of gross receipts and. Reporting location for the sale of services New Mexicos adoption of a destination-based sourcing approach for sales of.

Special fuel suppliers tax. New Mexico charges a gross receipts tax on persons engaged in business in the state for the privilege of doing business in the state. A a person who is not an Indian tribe or member thereof.

New Mexico producers are required to pay property taxes on residential as well as agricultural lands income tax assuming a profit is realized at both the state and federal level livestock ownership taxes self-employment taxes fuel taxes and state gross receipt taxes on consumptive goods. NM Stat 7-9-12 2019 Exemptions from either the gross receipts tax or the compensating tax are not exemptions from both taxes unless explicitly stated otherwise by law. Gross receipts are taxable exempt or deductible.

Imposition and rate of tax. 3 Receipts from the sale of tangible personal property in New Mexico in Indian country to the following persons are subject to the gross receipts tax. Businesses that do not have a physical presence in New Mexico including marketplace providers and sellers also are subject to Gross Receipts Tax if they have at least 100000 of taxable gross receipts in the previous calendar year.

Job Mentorship Tax Credit. New Mexico Taxation and Revenue Department FYI-105 REV. Your gross receipts may be exempt from gross receipts tax under Section 7-9-29 NMSA 1978.

TRD has the right to refuse to issue NTTCs to taxpayers who are delinquent in paying taxes. And c a person who is a. Tax rates vary across the state from 5125 to 88125 and the rate is determined as a combination of the rates imposed by the state the counties and the municipalities.

No forms are required. The receipt is taxable if no specific exemption or deduction applies to it. After registering with TRD and receiving a CRS identification number you may obtain an NTTC through TRDs NTTC webservice.

While many of the other exemptions apply to the taxes you file at the end of the tax year like the income tax the GRT applies at the end of the sale period. More information on this standard is available in FYI-206. Gross receipts tax and governmental gross receipts tax.

Occasional sale of property or services. However the Federal Government is only exempt from specific types of transactions in New Mexico. Low-Income Housing Tax Credit Program LIHTC Mortgate Finance Authority MFA Housing Tax Credits - Allocations.

Section 7-9-20 - Exemption. Receipts subject to one of the following taxes are exempt from governmental gross receipts tax. 2019 New Mexico Statutes Chapter 7 - Taxation Article 9 - Gross Receipts and Compensating Tax Section 7-9-12 - Exemptions.

Denomination as gross receipts tax. Isolated and occasional sale - Exempted from gross receipts tax are the receipts from the isolated or occasional sale of or leasing of property or a service by a person who is neither regularly engaged nor holding themself out as engaged in the. Section 7-9-19 - Exemption.

Pyramiding and Other Gross Receipts Tax Issues - 4 - Special Exemptions and Deductions There are many exemptions and deductions from the gross receipts tax base but most of these are necessary to define the gross receipts tax base and are not special For example the largest gross receipts tax exemption is for wages. 7112 Stadium Exemption Receipts from selling tickets parking souvenirs concessions programs advertising merchandise corporate suites or boxes broadcast revenues and all other products. Printable PDF New Mexico Sales Tax Datasheet.

For the privilege of engaging in business an excise tax equal to five and one-eighth percent of gross receipts is imposed on any person engaging in business in New Mexico. Exempted from the gross receipts tax and from the governmental gross receipts tax are the receipts from selling livestock and receipts of growers producers trappers or nonprofit marketing associations from selling livestock live poultry unprocessed agricultural products. Gross Receipts Tax and Marketplace Sales.

Section 7-9-18 - Exemption. Gross receipts tax and governmental gross receipts tax. Motor vehicle excise tax.

B a person who is an Indian tribe other than the Indian tribe on whose territory the sale takes place. The main incentive well be covering today is the New Mexico solar sales tax exemption known as the Solar Gross Receipts Tax Exemption GRT. The tax imposed by this section shall be referred to as the gross receipts tax.

New Mexico Taxation and Revenue Department FYI-105 REV. The oil and gas emergency school severance conservation and ad valorem taxes. Certain receipts of homeowners associations.

Exemptions apply to receipts that are not taxable and dont require reporting. Imposition and rate of tax. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that ranges from 0375 to 9062 across the state with an average local tax of 2095 for a total of 722 when combined with the state.

If all of a businesss receipts are exempt the business doesnt have to register with the state for GRT purposes. New Mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933. This Tax Alert summarizes some of the guidance on sourcing sales of services.

Hotels and lodging however are considered intangible property and are subject to gross receipts tax. For example centrally billed accounts are not subject to gross receipts taxes on tangible property. NM Stat 7-9-28 2018 7-9-28.

New Mexico considers you a tax-exempt organization if the federal government has first granted the status to you under Section 501 c of the Internal Revenue Code with a classification as an educational or social entity. To New Mexico gross receipts tax filing periods starting on and after July 1 2021. This tax package is about making a difference for every community in New Mexico said Rep.

New Mexico Sales Tax Use Tax Sourcing Explained Taxjar

How To Get A Non Taxable Transaction Certificate In New Mexico Startingyourbusiness Com

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico Governor Slashes Taxes As She Pursues Reelection

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Nm Acd 31052 2005 2022 Fill Out Tax Template Online Us Legal Forms

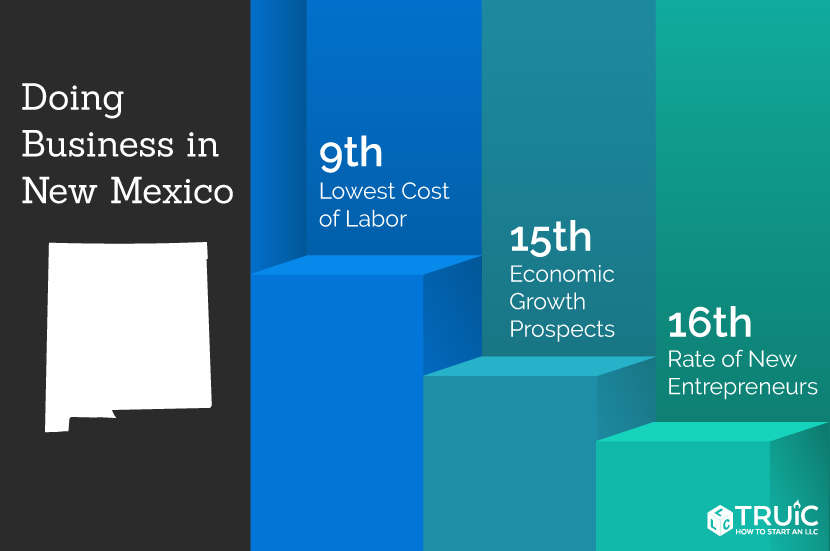

How To Start A Business In New Mexico A How To Start An Llc Small Business Guide

Business Guide To Sales Tax In New Mexico

Form Rpd 41260 Download Printable Pdf Or Fill Online Personal Income Tax Change Of Address Form New Mexico Templateroller

How To Register For A Sales Tax Permit In New Mexico Taxvalet

New Mexico Sales Tax Small Business Guide Truic

New Mexico S Sad Bet On Space Exploration The Atlantic

Greater Gallup Economic Development Corporation Taxes

A Guide To New Mexico S Tax System New Mexico Voices For Children

A Guide To New Mexico S Tax System New Mexico Voices For Children

Revenue Windfall Could Prompt Tax Cut Talks Albuquerque Journal